The global sunflower market enters the 2025/26 season with expectations of a significant recovery. Last year’s crop was one of the weakest in recent memory, with production ranging between 52.5 and 53 milion tons. This season, forecasts are notably higher, with estimates now between 56 and 59 MMT, reflecting improved conditions in the Black Sea region. Russia is set to expand production from 16.9 to 18.5 MMT, maintaining its position as the world’s top producer ahead of Ukraine with around 13 million tons.

In Europe, the picture remains uneven. Romania is on track for a stronger crop, reinforcing its role as the EU’s largest producer. In Bulgaria, initial harvest results are mixed – some farmers report very low yields of just 0,60 t/ha due to drought, while others achieve up to 2 t/ha, noticeably better than last year. In Ukraine, forecasts are being revised downward after heat stress and dry summer conditions cut crop potential. Dive into our latest Sunflower Market Update to see how mixed harvest results, shifting forecasts, and growing organic demand will shape trade decisions this season.

Ukraine Sunflower Market: Forecasts Revised

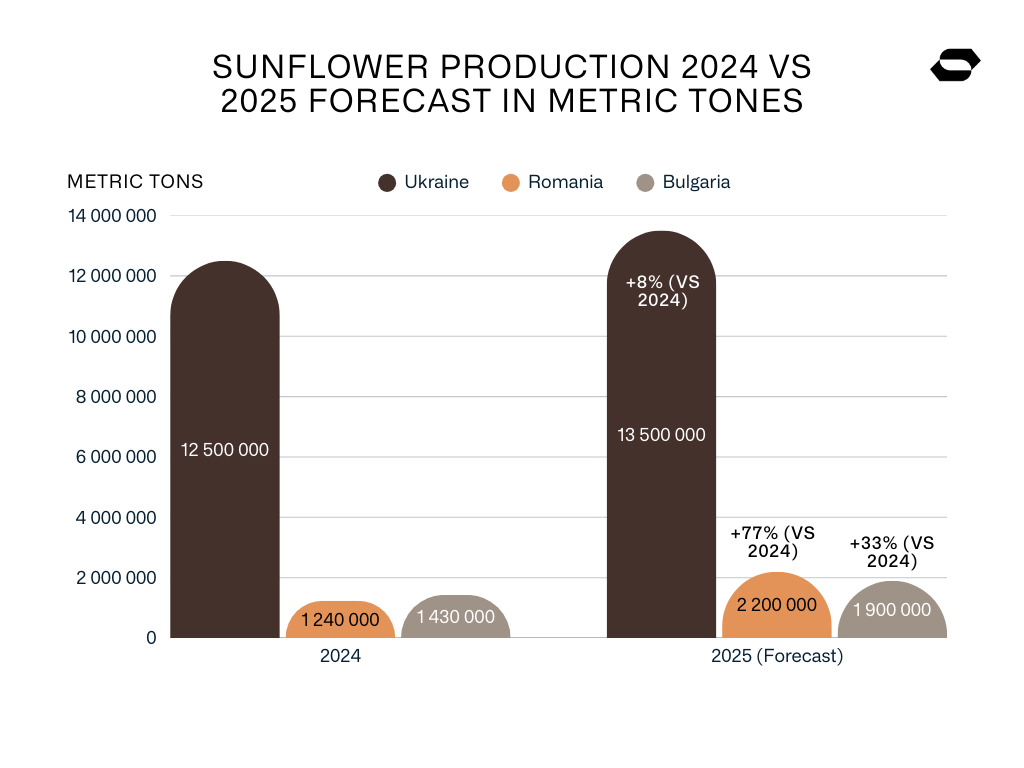

Ukraine remains the swing producer in the Black Sea sunflower market, but 2025/26 production forecasts have been revised downward. Estimates now range between 12.8 and 13.5 MMT, compared with earlier expectations of 14.1-14.5 MMT. Dry conditions in the south and east have cut yields, though rainfall in the north and west is helping to partially stabilize the crop.

Ukraine’s importance lies in its sunflower crushing industry. The country is the world’s largest exporter of sunflower oil, accounting for over 25% of global production. In 2024, sunflower oil exports reached 5.12 billion USD, a 2% increase from the previous year. Key buyers included India (for the first time, India purchased more sunflower oil from Ukraine than from Russia), Spain, and Romania, underlining Ukraine’s central role in both EU and global supply chains.

The combination of lower seed forecasts and quality concerns, alongside Ukraine’s dominance in the oil market, creates significant vulnerability. Even small changes in its harvest can have outsized effects on crushers, traders, and global price stability.

Bulgaria Sunflower Market: Bigger Crop Expected

Bulgaria remains the EU’s largest producer of sunflower kernels, and this season brings more optimism compared to last year’s historic low of approximately ~1.43 MMT. Fortunately, more and more reports are pointing to better yields across many producing regions. Some farmers achieving yield of ~2 t/ha, while others continue to struggle with drought-damaged fields reporting as little as 500 kg/ha.

In 2025, the sunflower sowing area increased by 67% year-on-year to 985 thousand hectares, which supports the expectation of a stronger overall harvest. The outlook is also supported by the wider grain market: wheat production reached ~7.1 MMT (10% more vs 2024). While oversupply pressured prices, it demonstrates that Bulgarian fields can deliver solid output this season also in sunflower.

On the price side, the sunflower kernel market has been volatile. Last season, bakery-grade kernels saw values rise sharply after harvest. In the peak, reaching almost 2,000 €/t FCA for organic sunflower kernels and about 1,300 €/t FCA for conventional kernels.

Sunflower Production: Romania’s Growth and Challenges

Romania enters the 2025/26 season firmly positioned as the EU’s largest sunflower seed producer, with harvest expectations around 2.2 MMT. The estimate is based on higher yield expectations, despite a 4% reduction in production area. With a projected 50% rise compared to last year, Romania is once again expected to top the EU producer.

The 2024 season, however, was one of the weakest in living memory. Due to adverse weather, Romania harvested only about 1.24-1.30 MMT, the smallest crop in 15 years and a 38% drop compared to 2023. This result was not only below Romania’s usual levels, but also lower than the 1.53 MMT collected in France and the 1.70 MMT harvested in Hungary, which surprisingly led EU-27 sunflower production in 2024.

Despite last year’s exceptional weakness, Romania’s long-term dominance in EU sunflower production remains unquestioned. Between 2019 and 2023, Romania accounted for 25.9% of the EU total volume, the highest share among member states. With stronger yields this year and better seed quality, the country is set to restore its central role in European supply and stabilize its position as the EU’s leading sunflower producer.

Sign up to Seedea Newsletter

Join and get the Latest News & Product Reports from Seedea. It’s free. No spam.

European Sunflower Production: Signs of Recovery

After one of the weakest seasons in nearly a decade, the EU sunflower sector is on the path to recovery in 2025/26. The International Grains Council (IGC) estimates sunflower production in the EU-27 at around 9.4 MMT. It is up 14% from last year’s depressed level of 8.3 milion tons.

For context, the five-year EU average (2020/21-2024/25) stood at 4.67 million hectares planted, 9.45 MMT harvested, and an average yield of 2.03 t/ha. That benchmark was not met in 2024, when poor weather drove yields sharply down and left Europe dependent on imports from Ukraine.

The picture in 2024 was especially striking. Hungary overtook Romania for the first time as the EU’s largest sunflower producer, harvesting around 1.70 MMT with a relatively strong yield of 2.42 t/ha despite drought issue. France came second with 1.53 MMT, while Bulgaria placed third at 1.43 MMT. The long-standing leader Romania fell back to fourth position, with only 1.24–1.30 MMT, its smallest crop in 15 years.

EU Organic Sunflower Market

The organic sunflower market in Europe is still suffering the consequences of a very difficult 2024 season. Production was extremely weak, with many fields producing underdeveloped, poor-quality seeds unsuitable for dehulling. As a result, organic sunflower kernel availability was limited and prices surged.

Farmers under pressure turned to pesticides in attempts to save their struggling crops, which created another layer of problems. Many organic batches delivered to EU customers were rejected after exceeding pesticide residue limits. Countries such as Hungary, the Czech Republic, and Bulgaria all faced these challenges during the season, putting further strain on supply chains and undermining buyer confidence.

The outlook for demand, however, is clear. Kernel-producing companies across Europe consistently report rising demand for organic sunflower kernels, especially from buyers seeking reliable long-term suppliers. This demand is creating a strong niche opportunity for farmers who can secure organic certification and deliver consistent quality.

Sunflower Market Update Summary

The European sunflower market shows signs of recovery in 2025, with production expected to rebound after last year’s historic lows. Romania is set to regain the lead at around 2.2 MMT, while Bulgaria’s larger sowings bring hope despite mixed yields. Ukraine’s forecasts have been revised downward to 12.8-13.5 MMT due to drought.

Kernel prices remain volatile, shaped by uneven harvest results and crushers cautious buying strategies. In the organic sector, supply remains tight after 2024’s disastrous crop, but demand is rising steadily, creating strong niche opportunities for farmers and exporters able to deliver consistent quality.

Source:

- “UkrAgroConsult updates Ukraine harvest forecast: Sunflower affected by drought” available at: https://ukragroconsult.com/en/news/ukragroconsult-updates-ukraine-harvest-forecast-sunflower-affected-by-drought-corn-shows-optimistic-results/ (accessed on August 28th, 2025).

- “Bulgaria may harvest record sunflower crop this year” available at:

https://agronews.ua/en/news/bulgaria-may-harvest-record-sunflower-crop-this-year/ (accessed on August 28th, 2025). - “Romania remains the EU’s largest producer of sunflower seed” available at:

https://ukragroconsult.com/en/news/romania-to-once-again-become-eus-largest-sunseed-producer/ (accessed on August 28th, 2025).