The global lentil market in the 2024/2025 season is experiencing a strong recovery, with overall production surpassing 2023 levels. Canada is reporting a record crop, significantly increasing its output compared to the previous year. Turkey maintains stable production with a shift toward more green lentils from 2024 crop, while Australia faces challenges due to frost damage, leaving its final harvest figures of 2024/2025 crop uncertain.

This report delves into the production statistics of Canada, Australia, and Turkey for 2023 and 2024, providing a comparative analysis of market trends. Additionally, it highlights the significance of organic production – a core focus for Seedea.

Global Lentils Market in 2024

Global lentil production in the 2024/2025 season is estimated to increase by 15%, reaching approximately 6.6 million tonnes, up from 5.7 million tonnes in the 2023/2024 season.

Canada remains the dominant producer, with Australia and India also playing key roles. India continues to be the largest importer of lentils, followed by Turkey and the United Arab Emirates, while demand remains strong in other emerging markets across the Middle East and Asia.

Canada, Australia, and Turkey remain the top three global exporters of lentils, supplying key markets such as India, Turkey, and the United Arab Emirates. These countries play a crucial role in shaping global supply dynamics, with Canada leading the market due to its record-breaking production in 2024.

Lentils Production in Turkey

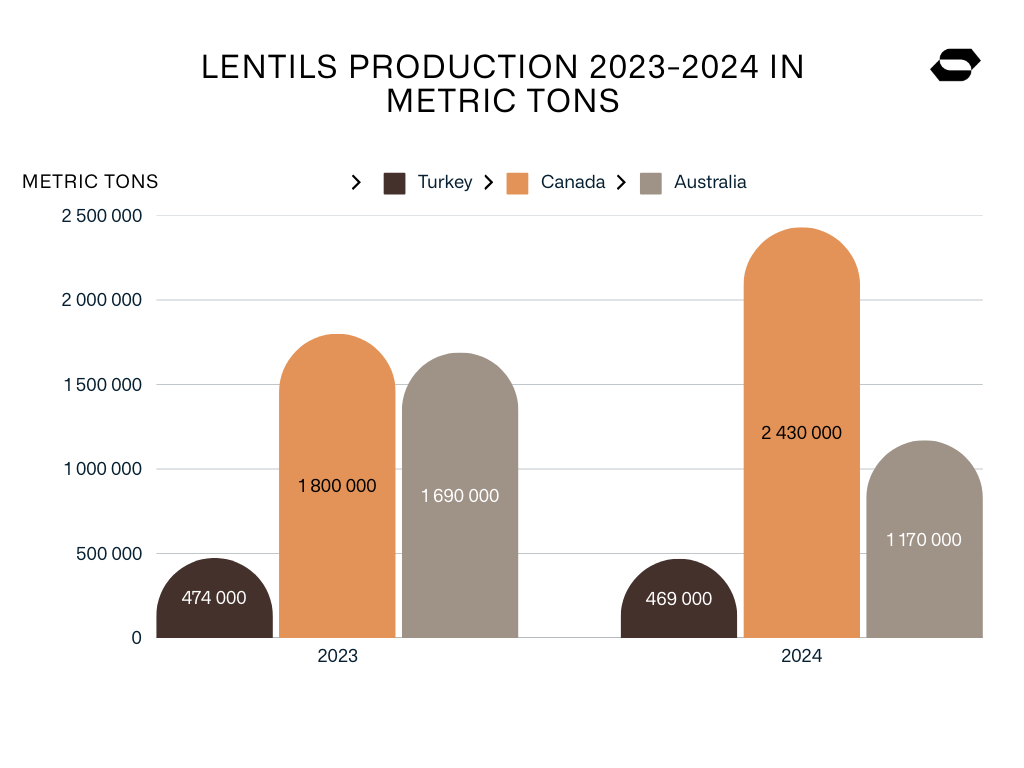

Considering that Turkey is both a significant producer and an even more important importer of lentils, its lentil production in 2024 reached 469 000 tonnes, reflecting a slight decrease from 2023.

- 2023: Total lentil production: 474 000 tonnes

- 2024: Total lentil production: 469 000 tonnes

This decline is mainly due to a 5.7% drop in red lentil production, partially offset by a 38% increase in green lentil production.

Production by type:

- Red lentils: 400 000 tonnes (-5.7%)

- Green lentils: 69 000 tonnes (+38%)

Turkey continues to rely on imports, with Canada as the primary supplier, accounting for 530 000 tonnes (61.6% of total imports). However, in recent years, Turkey has diversified its sources, increasing imports from Russia (131 000 tonnes) and Kazakhstan (120 000 tonnes).

According to TURKSTAT, Turkey’s total lentil imports in 2024 amounted to 430 000 tonnes, down from 860 300 tonnes in 2023.

Lentils Production in Canada

Canada’s total lentil production in 2024 is estimated at 2.43 million tonnes, marking a 35% increase from 2023 and surpassing the 10-year average by 3.6%.

- 2023: Total lentil production: 1.80 million tonnes

- 2024: Total lentil production: 2.43 million tonnes (+35%)

This surge is driven by a 16.4% increase in yield and a 15.9% expansion in harvested area. Saskatchewan remains the dominant production region, contributing 87% of total output, with Alberta accounting for the remainder.

Production by type:

- Large green lentils: 450 000 tonnes

- Red lentils: 1.7 million tonnes

- Other types: 250 000 tonnes

Canadian lentil exports are expected to grow significantly, reaching 2.1 million tonnes, with India, Turkey, and the UAE as the primary markets. Between August and November 2024, exports totaled 0.8 million tonnes, up 14% year-on-year. India accounted for the largest share (0.35 million tonnes), followed by Turkey and the UAE.

Lentils Production in Australia

Australia, a major exporter of high-quality lentils, has seen its 2024 production estimate revised downward due to frost damage, now expected to total 1.2 million tonnes, down from initial projections of 1.7 million tonnes.

- 2023: Total lentil production: 1.69 million tonnes

- 2024: Total lentil production: 1.17 million tonnes (-30,8%)

If AgPulse’s revised estimate of 1.17 million tonnes holds, this would mark a significant decline from previous seasons.

Production insights:

- 90% of Australian lentil production consists of red lentils, but green and specialty types are gaining market share.

- The Indian subcontinent remains the largest importer of Australian red lentils.

Despite lower production, Australia remains a key global exporter, with export volumes averaging 105% of production over the past five years. Final production figures are still pending confirmation.

Sign up to Seedea Newsletter

Join and get the Latest News & Product Reports from Seedea. It’s free. No spam.

Organic Lentils Market in Europe

After the post-COVID-19 slowdown and the disruptions caused by the war in Ukraine, demand for organic food is gradually rising again, driven by both increased local production and imports. France continues to expand its organic lentil production, while Italy remains a key importer, relying heavily on supplies from Turkey.

Organic Lentils Production in France

In 2022, France produced 28 166 tonnes of lentils, with 12 000 to 14 000 tonnes of organic lentils grown each year. Green lentils dominate French production, accounting for 88% of total lentil output in 2023. Premium labels like Lentille verte du Puy and Lentille verte du Berry maintain strong market positions in France. Organic cultivation is mainly concentrated in Centre, Champagne-Ardennes, and Auvergne-Rhône-Alpes.

Organic Lentils Production in Italy

In 2024, Italy cultivated 5 330 hectares of lentils, but official organic production data is unavailable. Italy remains Europe’s largest importer of organic lentils, with imports surging from 4 300 tonnes in 2022 to 7 442 tonnes in 2023—a 73% increase in just one year. Turkey remains the primary supplier of organic lentils in Italy, providing 6 734 tonnes in 2023.

To explore our available lentils offers visit our Marketplace.

Lentils Market Summary

The 2024/2025 season sees global lentil production rebounding, up 15% to 6.6 million tonnes, with Canada leading growth in 2024. Pricing volatility is possible in this season (2024/2025), with Canada’s surplus softening prices while regional shortages may appear elsewhere.

The organic sector is gaining traction, particularly in Europe, where demand is again increasing. However, with France and Italy dominating production, there is a clear niche for new suppliers to enter the market. This shift presents opportunities for emerging producers looking to capture the growing demand for organic lentils.

If you are working with pulses, you can read our latest Chickpeas Market Update – October 2024. Understanding trends in the chickpea market can provide a broader perspective on the pulse industry.

Source:

- “Dried Lentils, Shelled Exports by Country in 2022” available at: https://www.fao.org/faostat/en/#data/QCL (accessed on March 5th, 2025).

- “Crop Production Statistics, 2024” available at:

https://data.tuik.gov.tr/Bulten/Index?p=Crop-Production-Statistics-2024-53447&dil=2 (accessed on March 5th, 2025). - “Analysis of Lentil Import in Turkey by Country of Origin” available at:

https://ab-centre.ru/news/analiz-importa-chechevicy-v-turciyu-po-stranam-proishozhdeniya-v-2022-2024-gg#:~:text=%D1%82%D0%BE%D0%BD%D0%BD (accessed on March 5th, 2025). - “Outlook for Canadian Peas & Lentils’ available at:

https://saskpulse.com/resources/outlook-for-canadian-peas-lentils-2/ (accessed on March 5th, 2025). - “Australian Pulse Market Situation” available at:

https://saskpulse.com/resources/australian-pulse-market-situation/ (accessed on March 5th, 2025). - “La Production de Lentilles en France” available at:

https://chambres-agriculture.fr/actualites/actualite/la-production-de-lentilles-en-france (accessed on March 5, 2025). - “Bio in Cifre 2024” available at:

https://www.sinab.it/sites/default/files/Bio%20In%20Cifre%202024.pdf (accessed on March 5, 2025).