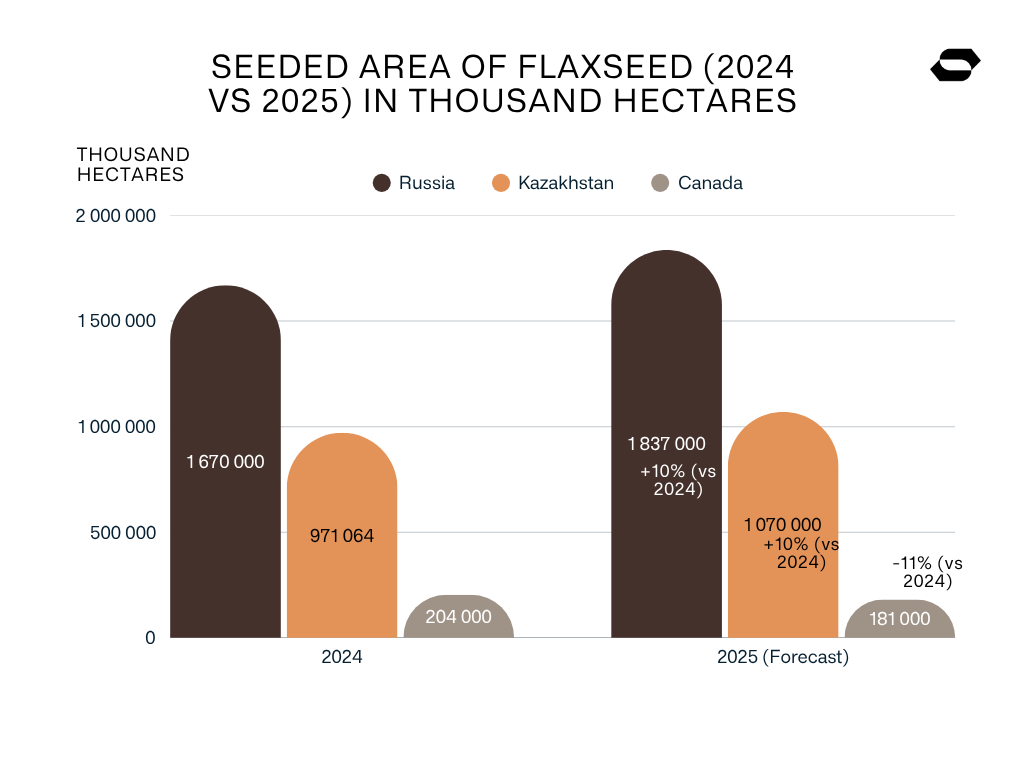

As flaxseed buyers and processors plan for the 2025/26 season, they face a market shaped by important changes. Russia and Kazakhstan are increasing their flaxseed acreage by around 10% in 2025, reacting to stronger demand and weaker profitability in other crops. In contrast, Canada is reducing its sowing area to the lowest level in over a decade. On top of that, global supplies remain tight, prices are rising, and the EU’s 50% import duty on Russian flaxseed is forcing importers and traders to rethink their purchasing strategy.

In this article, you’ll find key production figures, side-by-side charts for 2024 vs. 2025, insights from exporters on the ground, and a dedicated look at the organic flaxseed segment. It’s your complete guide for smart sourcing decisions this season.

Global Flaxseed Market in the 2024/2025 Season

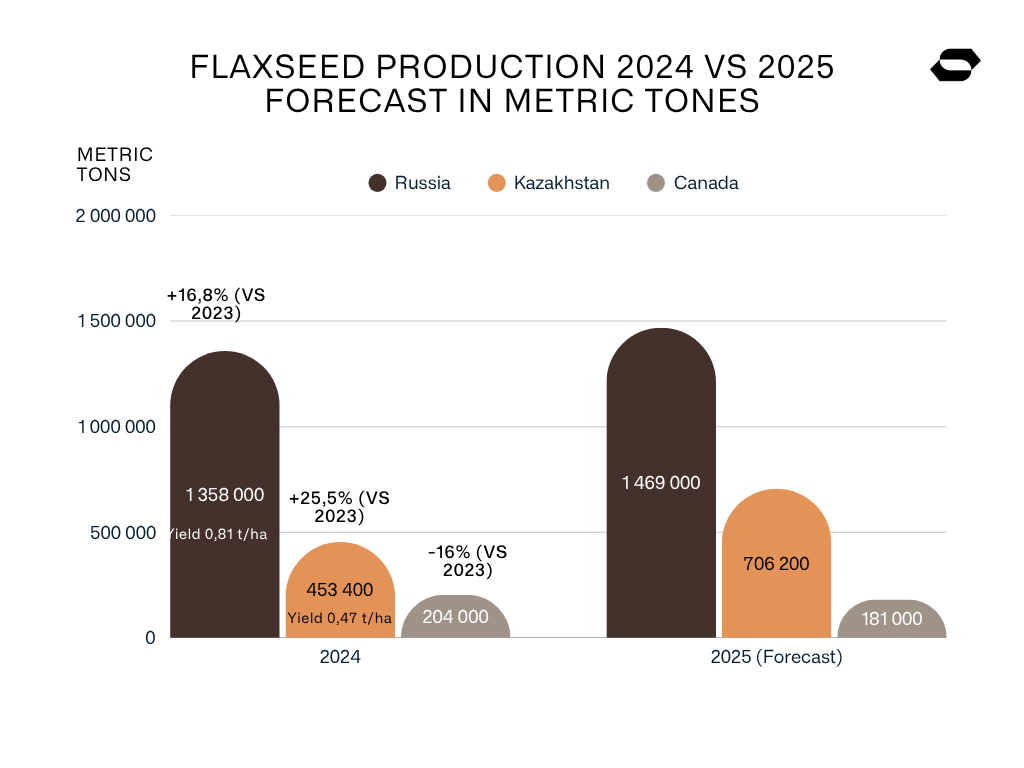

In 2024, Russia remained the leading flaxseed producer with 1.36 million tons, followed by Kazakhstan with 453 400 tons and Canada with 204 000 tons harvested.

Yield played a decisive role – Russia achieved a solid 0.80 t/ha, while Kazakhstan struggled with only 0.47 t/ha, far below its 10-year average of 0.80 t/ha. Canada maintained high yields near 1.00 t/ha, but with record-low production, its total output dropped to a 10-year low, weakening its global market position.

In terms of imports, China continues to dominate global flaxseed imports, but total volumes fell sharply in 2024. The global flaxseed import volume reached just 693 000 tons – a 43% drop compared to 2023 (1.22 million tons).

Russia was the main supplier with 527 000 tons (76% of total imports), followed by Kazakhstan with 123 000 tons (18%). Other key importers included Belgium, the United States, and Poland. These shifts reflect the impact of EU tariffs and the reorientation of trade flows across major markets.

Russia’s Flaxseed Industry in 2024/2025: Supply, Demand and Trade Insights

Russia remains the world’s largest flaxseed producer. In 2024, total production reached 1 358 000 tonnes, showing a strong increase of 16.8% compared to 2023.

- 2023: Total flaxseed production: 1 153 000 tonnes

- 2024: Total flaxseed production: 1 358 000 tonnes (+16.8%)

Gross flaxseed harvest in 2024 amounted to 1 346 300 tonnes, up by 193 300 tonnes from the previous year. This was the second-largest flaxseed harvest in Russian history, following the record year of 2022 (1 734 400 tonnes).

Russia remains a key global exporter, with China absorbing 527 000 tonnes in 2024. However, exports to the EU declined sharply after EU introduced a 20% import duty on Russian flaxseed starting January 1, 2025. This duty is expected to rise to 50% from January 1, 2026.

In Q1 2025, Russia exported only 167 000 tonnes of flaxseed to the EU, compared to 370 000 tonnes in Q1 2024—a 55% drop in just one year. To respond, Russian exporters are pivoting toward Asian markets and expanding flaxseed oil processing capacity, aiming to reduce dependency on unprocessed seed exports.

Kazakhstan Flaxseed Market: Production Volumes and Outlook

Kazakhstan remains the second-largest flaxseed producer globally, although its output has been highly unstable in recent years. In 2024, total production reached 453 400 tonnes, marking a partial recovery after the weak 2023 season.

- 2023: Total flaxseed production: 361 700 tonnes

- 2024: Total flaxseed production: 453 400 tonnes (+25.3%)

The rebound was driven by an increase in sown area and slightly improved field conditions. However, the average yield remained low at just 0.47 t/ha, well below the 10-year national average of 0.80 t/ha. Many farmers struggled with limited crop rotation and highly variable weather patterns, which held back potential, better output.

Weak domestic wheat sales and heavy competition from cheap Russian grain have pushed farmers to switch crops. Despite these challenges, the analytics committee of the Kazakhstan Grain Union sees room for further growth in flax cultivation.

“Kazakhstan can truly replace Russia [in the flaxseed] exports to the EU. We can already see how much Kazakh flax shipments to EU markets have grown compared to the last/previous marketing [agricultural] years. Russian flax’s export geography next marketing year will likely be limited to China and Turkey.“

With flaxseed prices rising and profitability improving, producers are looking to scale up. Initial estimates suggest a 10% increase in sown area for 2025, although this will be confirmed after seeding is complete.

Canadian Flaxseed Production Statistics and Forecast

Canada, once a global leader in both flaxseed production and exports, is gradually losing its position in the world market. While it still ranks as the third-largest producer, its role is much smaller than in previous years.

In 2024, Canada harvested just 201 000 tonnes, marking one of the weakest results in over a decade.

- 2023: Total flaxseed production: 258 000 tonnes (area: 239 000 ha)

- 2024: Total flaxseed production: 201 000 tonnes (area: 201 000 ha, -16%)

The decline stems mainly from shrinking planted area, while yields remained strong at ~0.99 t/ha. Canadian farmers continue to shift away from flax in favor of higher-margin crops. Domestic use dropped to 92 400 tonnes, and exports are projected at around 250 000 tonnes, partly supported by leftover inventories.

The outlook for 2025 is even weaker. Planned area is expected to fall to 181 000 hectares, with production likely to reach only ~180 000 tonnes. That would bring total supply down again and a new record low. However, tight supply is pushing prices higher. Maybe this will encourage farmers to grow more flaxseed again for the 2026 crop?

Sign up to Seedea Newsletter

Join and get the Latest News & Product Reports from Seedea. It’s free. No spam.

Organic Flaxseed Market in 2024/2025

The organic flaxseed market remained stable in the 2024/25 season despite rising prices in the conventional segment. Most of the organic raw material continues to come from Kazakhstan, which remains the main global supplier, followed by selected EU countries, where organic acreage is gradually expanding.

This season stood out compared to the previous one: availability lasted longer, and raw material did not run out as early as in 2023. Buyers could secure contracts at relatively attractive prices – even with pressure from the rising cost of conventional flax.

At the same time, EU buyers are increasingly looking toward European-origin flaxseed. This is driven not only by logistical concerns but also by client preferences and stricter certification standards, especially among large processors and private label brands.

At Seedea, we already offer certified organic EU-origin flaxseed from countries such as Poland, Czech Republic, Romania, and Lithuania-available both spot and on forward contracts basis.

Key Pressure Points in the Flaxseed Market and What’s Ahead

- Rising prices overall left little room for negotiation this season. Buyers came in expecting discounts, as usual, with plenty of exporters. But since harvest, prices have gone up week after week. This mismatch between buyer expectations and real costs made deals harder to close.

- HCN acid levels remain a challenge, especially for the food sector. Many exporters now test every batch. Results vary by region and season, adding delays and costs – especially for shipments into Europe. Batches with clean pesticide results and low HCN levels were in strong demand and gained value.

- Golden flaxseed saw the strongest price spike. Weak production and poor quality in 2024 pushed prices to multi-year highs. Clean product with low moisture and good oil content was hard to find. Brown flax remained available, but the price gap increased steadily throughout the season.

- With the EU duty on Russian flax rising to 50% in 2026 (or earlier), supply pressure is expected to increase further. Buyers are now watching 2025 crop estimates closely – especially in Kazakhstan and Russia, where sowing has slightly increased.

Flaxseed Market Summary

The 2024/25 flaxseed season confirms a key trend: lower availability, higher prices, and shifting trade flows. Russia remains the top producer, but its access to EU buyers is shrinking due to rising duties. Kazakhstan is scaling up again, but yields stay very weak.

Looking ahead, the final outcome of Kazakhstan’s harvest and yield will play a key role.

On the buying side, organic supply stayed more stable, with European buyers turning closer to home. Meanwhile, quality concerns (HCN, moisture) and limited availability – especially in golden flax – kept pressure on prices.

Source:

- “Сборы масличного льна в России в 2024 году выросли на 16,8%” available at:

https://oleoscope.com/news/sbory-lna-v-rossii-v-2024-godu-vyrosli-na-16-8/ (accessed on June 6th, 2025). - “Kazakhstan could fill Russia’s niche in EU flaxseed market” available at: https://www.interfax.com/newsroom/top-stories/111851/ (accessed on June 6th, 2025).

- “Canada: Outlook for Principal Field Crops, 2025-05-21” available at:

https://agriculture.canada.ca/en/sector/crops/reports-statistics/canada-outlook-principal-field-crops-2025-05-21 (accessed on June 6th, 2025).