This October 2024 Chickpeas Market Update explores the key production across major regions like Turkey, Australia, and Russia, along with insights into key EU producers such as Spain, France, and Italy. What factors are keeping Turkey’s production steady? How has Russia risen to become the second-largest exporter for the first time? And is Australia set to exceed a million tons in harvest again?

This article offers essential insights into trade dynamics and market trends, providing a comprehensive overview of the chickpea market for decision-makers and industry professionals.

Turkey Chickpeas Production 2024

According to the latest data from TURKSTAT, Turkey’s chickpea production is projected to remain stable at approximately 580 000 tons in 2024, matching figures from the past two years. Chickpeas are Turkey’s most widely cultivated legume, with the majority grown in three key regions—Ankara, Yozgat, and Kırşehir—which together contribute roughly 40% of national production.

Domestic consumption remains high, ranging between 400 000 and 450 000 tons annually. Turkey is also a significant player in both the export and import markets for chickpeas. In recent years, imports have been largely sourced from Russia, accounting for over 60% of total imports in the 2022/2023 season. Import volumes have surged dramatically, rising from just 21 000 tons in the 2019/2020 season to 217 000 tons in 2022/2023, reflecting Turkey’s growing demand for chickpeas from external markets.

Turkey ranks as the 3rd or 4th largest chickpea exporter, with exports reaching 231 000 tons in the previous season, a volume that has remained relatively stable. Its export position fluctuates based on production levels in Mexico and Canada, another important net exporters of chickpeas. Turkish main export destinations are Algeria, Iraq, and Italy, which together accounted for 53% of total exported volume last season.

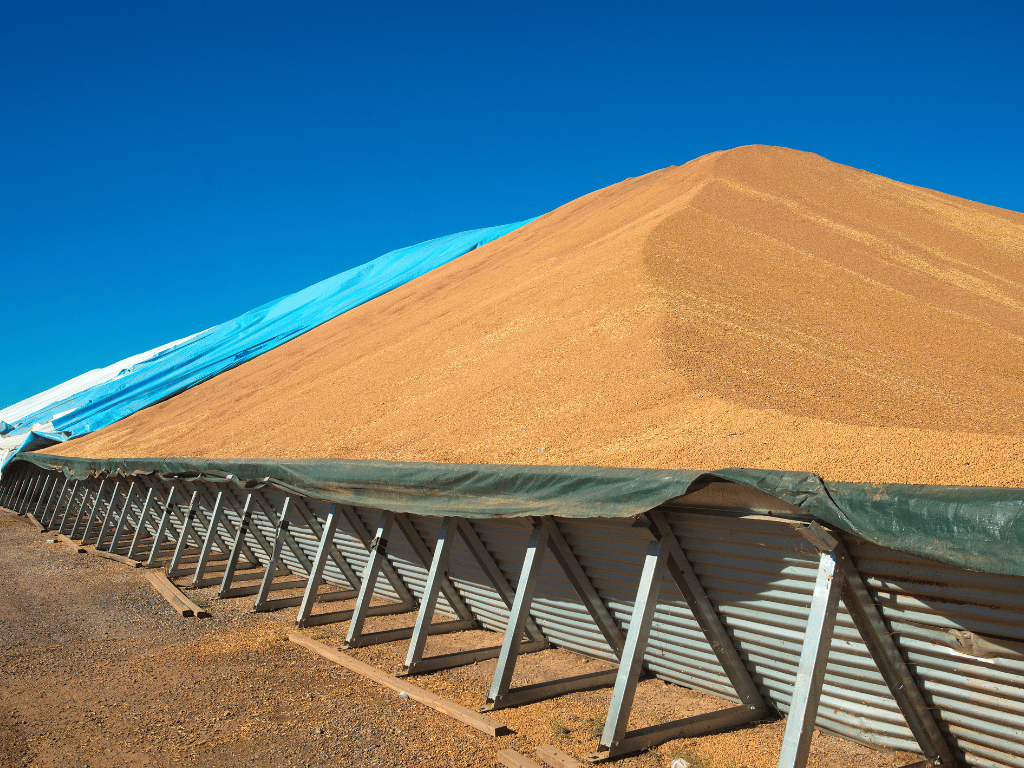

Australia Chickpeas Production

Australia, while not the world’s top producer of chickpeas, stands as the largest global exporter. According to the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES), Australia’s chickpea production is forecasted to reach 1.333 million tones for the 2024–25 crop year, covering a seeded area of 1.9 million acres—an increase of 70% above the 10-year average.

This marks the largest area sown for chickpeas since the 2017–18 season and the highest production since 2016–17. In comparison, the previous year saw a significantly lower output of just 491 000 tonnes.

Over the past decade, Australia has consistently held its position as strong chickpea exporter. In 2022–23, Australia exported most of its chickpeas to Pakistan (54%) and Bangladesh (24%), accounting for 35% of global exports. Over the past decade, Australia has maintained its status as a leading exporter, contributing roughly one-third of global chickpea exports.

Sign up to Seedea Newsletter

Join and get the Latest News & Product Reports from Seedea. It’s free. No spam.

Russia Chickpeas Production

In 2023, Russia set a record in chickpea production, reaching 702 800 tons – a 50% jump from the previous year’s 467 900 tons. According to Rosstat, the area planted with chickpeas reached 492 100 hectares, a 34% increase year-over-year. The Institute for Agricultural Market Studies (IKAR) noted that in 2024 season, land dedicated to chickpeas and lentils cultivations in Russia grew by an another 610 000 hectares.

With a clear focus on exports and low domestic consumption, Russia channels most of its chickpea harvest to international markets. In 2023, Russia became the second-largest exporter after Australia, with exports hitting 540 000 tons—double the volume of 2022. Turkey, Pakistan, and Egypt were the top importers, and only in Q1 2024, Russia had already moved roughly 60% of its 2023 chickpea harvest abroad.

European Chickpeas Production in 2024

Spain Chickpeas Production 2024

Spain’s 2024–2025 chickpea crop area has grown significantly, with 77 600 hectares planted—up 19.3% from the previous year’s 65 000 hectares. This increase, combined with improved yields, has led to a harvest of 77 700 tons, compared to 47 000 tons in 2023, making 2024 a strong year for Spanish chickpea producers. However, despite the boost in yield, producers are facing challenges with low selling prices, which have been negatively impacted by high production of chickpeas also in other countries.

Despite this boost, Spain remains the largest chickpea importer in Europe. Approximately 71% of imported chickpeas come from the United States, 15% from Mexico, and the remaining 14% from Argentina and Canada in equal parts. The primary driver for imports is economic, as competitive prices from these high-producing countries make it more cost-effective for Spanish importers to rely on foreign chickpeas.

France Chickpeas Production 2024

In 2023, France cultivated 24 000 hectares of chickpeas, with over 7 600 hectares dedicated to organic production. Producing nearly 30 000 tons of chickpeas in total in 2023. However, France still relies on imports to meet demand, bringing in 20 091 tons primarily from Canada, Turkey, and the United States.

Italy Chickpeas Production 2024

In 2023, Italy experienced stable yet limited chickpea cultivation at 14 227 hectares, a notable decrease from the peak of 26 024 hectares in 2018. Italy still imports over 50% of its chickpeas, primarily from Turkey and Mexico. This year, challenging conditions affected both organic and conventional yields, leading to lower production.

Organic Chickpeas Market

France leads as the largest producer of organic chickpeas in Europe, cultivating 7 600 tons, contributing about 40% of the total organic chickpea production. However, Turkey supplied the majority of organic chickpeas consumed in Europe, harvesting 19,567 tons in 2022 and 13,896 tons in 2023. These imports typically flow through Italian and French importers. Turkish exporters have a competitive advantage due to favorable pricing compared to European sources, making them a preferred choice for many EU based buyers.

Chickpeas Market Summary

Turkey’s chickpea production remains stable at approximately 580 000 tons, while Australia continues to lead as the largest global exporter, likely achieving a record harvest in the 2024/25 season with over 1.3 million tons. Russia has also set new production records, reaching 702 800 tons, significantly bolstering its export capabilities. In response to strong export interest, Russia is planning to expand its chickpea cultivations further.

In EU, Spain continues to be the largest producer and importer of chickpeas in Europe. While France and Italy are significant contributors to chickpea production, they rely heavily on imports to meet demand. France stands out as a leader in organic chickpea production within Europe, but Turkey remains the primary supplier of organic chickpeas.

Source:

- “Crop Production 2nd Estimation, 2024” available at:

https://data.tuik.gov.tr/Bulten/Index?p=Crop-Production-2nd-Estimation-2024-53448 (accessed on October 30th, 2024). - “Australian Chickpea Crop Seeds Major Extension” available at:

https://farmtario.com/daily/pulse-weekly-australian-chickpea-crop-sees-major-expansion/ (accessed on October 30th, 2024). - “Рост посевных площадей под нутом и чечевицей в России в 2024 году” available at:

https://graininfo.ru/news/rost-posevnykh-ploshchadey-pod-nutom-i-chechevitsey-v-rossii-v-2024-godu/ (accessed on October 30th, 2024). - “Avances: Superficies y producciones de cultivos en 2024” available at:

https://www.mapa.gob.es/es/estadistica/temas/estadisticas-agrarias/cuaderno_agosto2024_tcm30-695999.pdf (accessed on October 30th, 2024). - “Chifres Cles 2023: available at: https://www.terresunivia.fr/fichiers/publications/chiffres-cles-2023.pdf (accessed on October 30th, 2024).